Company valuation using multipliers is a valuation method that is frequently used in practice. Multiplier valuation is a market-oriented valuation approach (market approach) that is based on prices already achieved on the market and thus on information processed by the market (Dietmar Ernst, Sonija Schneider, Bjoern Thielen, p. 189).

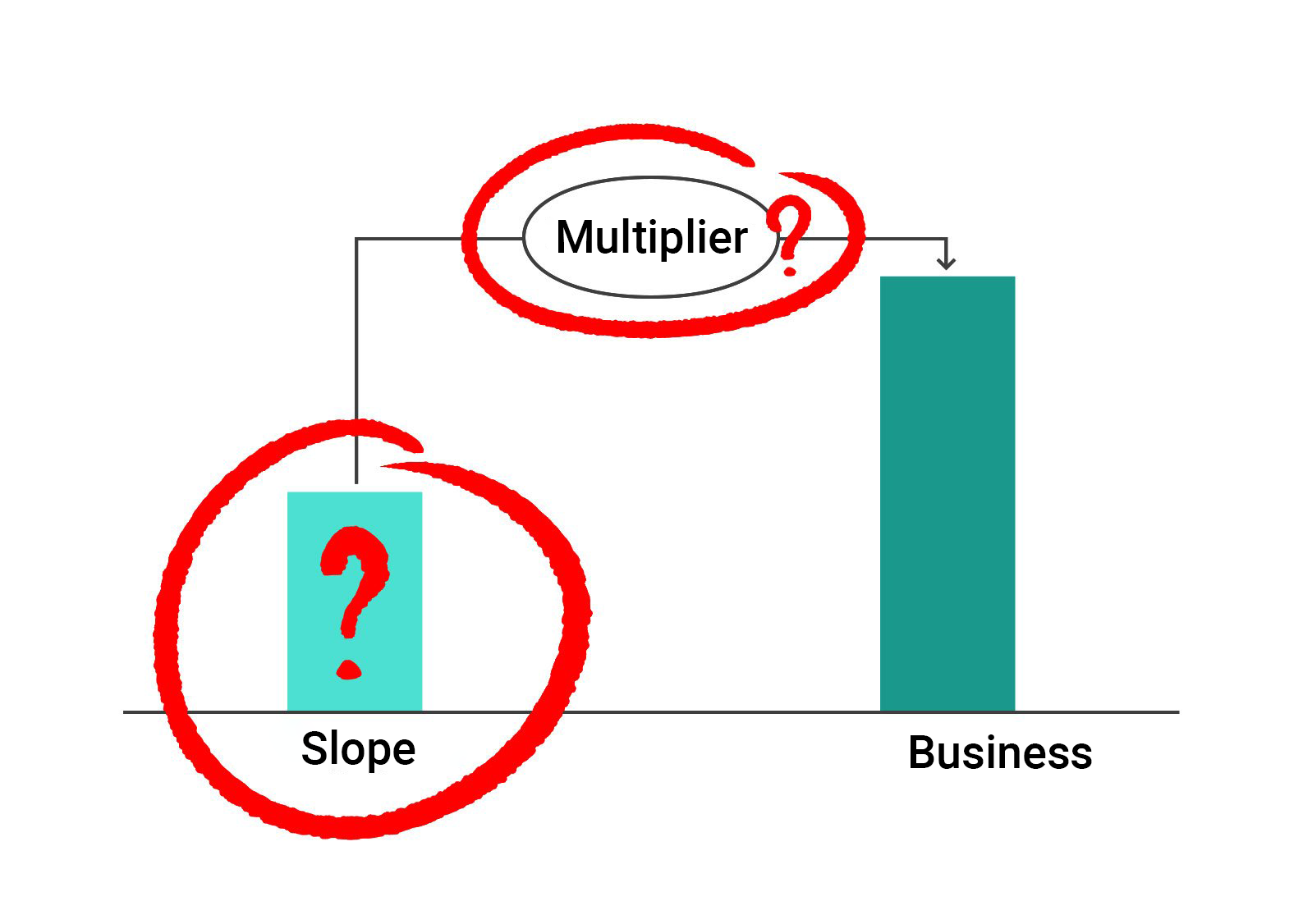

The particular appeal of the multiplier method lies in its simplicity and ease of understanding, at least at first glance. To determine the total value of the company, the multiplier is multiplied by the corresponding reference value of the company being valued.

The mathematics behind the valuation method is certainly not rocket science—the formula only has two components. The first component—the multiplier—is determined based on market data from comparable companies at a specific point in time. The second component – the reference value – is calculated using data from the company being valued. Figures from the balance sheet, income statement, cash flow statement, or other key figures of the company can serve as reference values (Dietmar Ernst, Sonija Schneider, Bjoern Thielen, p. 191). However, when determining the second component, a crucial question arises that often only experts with extensive experience can answer: Which reference value should be considered for the company?

When classifying the reference value, consideration should be given to the extent to which it can be influenced by external and internal factors. The most commonly used reference values are examined in more detail below.

| reference value | Explanation / Calculation | Advantages/disadvantages |

| EBITDA | EBITDA = Operating profit before interest, taxes, depreciation, and amortizationEBITDA = Revenue – operating costs (personnel, material, and other operating expenses) | + Takes into account the company’s earning power+ Eliminates differences in the capital structure of comparable companies and associated costs+ Eliminates differences in the (re)investment behavior of comparable companies – Assumes identical investment intensities (and thus equal depreciation) for comparable companies and the company being valued- Not useful in the case of negative EBITDA |

| EBIT | EBIT = Operating profit before interest and taxesEBIT = EBITDA – Depreciation and amortization | + Takes into account the company’s earning power+ Takes into account differences in investment intensity+ Eliminates differences in the capital structure of comparable companies and associated costs – Distortion due to different depreciation methods- Not useful in the case of negative EBIT |

| Umsatz | Revenue according to the income statement (from the annual financial statements or business assessment) or according to the company’s financial planning | + Also applicable in the case of negative operating results or profits+ Minimal influence of accounting methods and different tax systems – No consideration of the company’s earning power- Dependence on the definition of revenue |

EBITDA and EBIT multiples take into account the company’s earning power and are therefore most commonly used in practice. When applying an EBITDA multiple, the influence of accounting and valuation methods is minimal. A significant disadvantage compared to EBIT-based valuation is the treatment of capital intensity, which is not taken into account when using the EBITDA multiplier. If capital intensity is relevant to the valuation, EBIT may be more appropriate.

The revenue-based multiplier valuation has a serious disadvantage: it neglects the earning power of the respective company. A valuation based on revenue should therefore only be carried out if no other valuation is possible (e.g., in the case of negative EBITDA/EBIT), and the values calculated in this way should be interpreted with the necessary care (Dietmar Ernst, Sonija Schneider, Bjoern Thielen, p. 202). The determination of the company value using the sales multiplier should be applied in the case of the following company characteristics:

- The company has a labor-intensive business model, and its employees are an important driver of success (know-how).

- Increased personnel expenses (or hiring additional employees) can be seen as a driver of overall performance growth that cannot be immediately reflected in the results;

- Strong growth phases (e.g., also in young companies) in which EBITDA and EBIT are not yet sustainable indicators.

Conclusion

Depending on the company being valued, key figures are taken into account that reflect the respective characteristics and value drivers. In individual cases, suitable multipliers must be carefully selected in order to capture company-specific differences, such as varying profitability or capital intensity, as far as possible. Strict application of the multiplier approach therefore requires intensive analysis of the valuation object, the comparable companies, and the industry (IWW Institute, Business Management Client Support – Issue 09/2003, page 248).

Sources

- McKinsey & Company Inc., Valuation: Measuring and Managing the Value of Companies, 5th edition, Wiley Finance, 2010

- D. Ernst / S. Schneider / B. Thielen, Creating and Understanding Company Valuations, 5th edition, Vahlen Verlag Munich, 2012

- R. Aurora / K. Shetty / S. Kale, Mergers & Acquisitions, Oxford University Press, 2011

- G. Picot, Handbook of Mergers & Acquisitions, 5th edition, Schäffer-Poeschel, 2012

- IWW Institute, Business Management Client Support – Issue 09/2003, Valuing Companies Using the Multiplier Method